Research

The fundamentals of Arbitrum

This research piece has been written by Michael Nadeau from The DeFi Report, in collaboration with Token Terminal.

Abstract

Arbitrum is a layer 2 blockchain built on Ethereum. Its developer, Offchain Labs, launched the platform on August 31, 2021, with the goal of improving user experiences via lower fees and faster throughput. We like to think of L2s as “broadband for Ethereum.” YouTube, game streaming, and SaaS businesses were not possible before broadband came to the internet. Similarly, we think L2s could spark the next generation of use cases for Ethereum — catalyzing a new era of development as the ecosystem matures.

In this week’s memo, we cover the following:

- The problem

- The solution

- The business model

- Apps driving the most value to Arbitrum (and it’s competitors)

- Addressable market

- Product

- Team, investors, community

- Financials

- Token economics

- Competition

- Why now

- Risks

- Conclusion

1. The problem

Ethereum sells block space. That’s the product — but there is only so much of it. Supply is inelastic to demand. As such, when demand increases, Ethereum becomes slow and expensive. If you’re a developer trying to find a product/market fit for your new app, this is a problem. Furthermore, Ethereum lacks flexibility and customizability — constraining the universe of use cases for app developers.

Taking a step back. In many ways, the development of the Ethereum tech stack is mirroring that of the internet. In the early days, if you wanted to host a website, you had to run your own physical servers. And then Geocities came along — allowing developers to leverage shared servers. Over time, innovation became constrained by the lack of flexibility offered by Geocities. Virtual servers became the answer when AWS was born. Along with AWS came e-commerce, SaaS businesses, and social media — all of which were not possible in the early days of the internet.

2. The solution

Arbitrum expands the supply of blockspace available to app developers while enhancing the user experience — leading to greater throughput and a 95% reduction in fees compared to L1. A win/win for developers and users. With Arbitrum, this is accomplished while maintaining interoperability and security with Ethereum as the shared settlement layer.

Meanwhile, solutions such as Arbitrum Orbit and Arbitrum AnyTrust allow app developers to build customizable blockchains serving specific niche use cases. Used in conjunction with data availability networks such as Celestia, these L2 solutions look quite similar to the move from Geocities (Ethereum) to AWS in the early days of the internet.

In summary, solutions such as Arbitrum are laying the infrastructure for the next wave of blockchain-based applications. “The broadband moment” for the Ethereum ecosystem if you will.

3. The business model

Arbitrum is essentially a reseller of Ethereum’s block space. One way to think about this is to consider the last time you tried to send a bunch of large documents in an email. Because of the constraints concerning the volume of data being transferred, you probably had to put the files into a zip folder — bundling and compressing the data in the process.

This is sort of how L2s like Arbitrum work. Arbitrum processes many transactions at low fees, bundles them, and then posts the “call data” to Ethereum in one transaction.

Here’s what that looks like in terms of revenues generated (fees paid by users on apps leveraging Arbitrum) vs Arbitrum “call data” fees paid to Ethereum validators:

365-day “call data” costs paid to Ethereum: $34.2m

Net value to Arbitrum: $13.2m

Gross Margin: 27.8%

4. Which apps are driving value to Arbitrum?

Where does Arbitrum have product market fit? Is it DeFi? Is it NFTs? Games? Payments? Bridges? Or something else?

Let’s take a look under the hood, starting with 365-day gas fees.

Bridges (Stargate & LayerZero) are driving the most gas fees to Arbitrum today — which makes sense as users have to first move their assets over to Arbitrum from Ethereum. Aside from bridging activities, DeFi & payments are driving the most activity on Arbitrum.

Let’s compare this to the more recent 30-day trends:

“MEV Bot,” AKA a “high-frequency trader” on DEXs has driven the most activity to Arbitrum over the last 30 days. Almost more value than Uniswap and GMX combined. Let that one sink in for a second.

What about 365-day transactions?

Not surprisingly, we see a lot of the same names showing up.

Comparing Arbitrum to Competing L2s

Starting with OP Mainnet, the second largest L2 by TVL:

Similar to Arbitrum, LayerZero (bridging) is driving the most gas consumption over the last year.

Most activity on OP Mainnet is DeFi & payments — with the exception of Galxe — a protocol that helps businesses build customer loyalty programs with on-chain data. Note that there are still a lot of “unlabeled” contracts on OP Mainnet — which we expect to get more insight into soon.

Here’s Coinbase’s recently released L2, Base:

Base shows some differentiation. Having launched just 3 months ago, the strongest product/market fit has been with friend.tech — a new web3 social media platform that has already generated over $1 million in gas fees.

[Note that “unverified” is the combination of a number of on-chain contracts yet to be labeled — rather than any single project.]

Polygon (a side chain rather than an “ L2 rollup.” Polygon uses its own token to pay for user fees):

It's fascinating to see Chainlink (the largest data oracle network in web3) making a strong appearance here. Planet IX is a crypto game. CoinTool is an “online crypto toolbox.” Finally, it’s nice to see Lens Protocol (social media) making the list. It’s nice to see some differentiation from Polygon.

Finally, let’s take a look at a competing L1, Avalanche:

The biggest takeaway with Avalanche? Its top 10 projects have driven fewer gas fees than every L2 covered in this report — by a wide margin. Here’s the full scorecard:

Arbitrum: $14.8m in gas fees from the top 10 projects

Polygon: $12.2mm in gas frees from the top 10 projects

OP Mainnet: $11.9m in gas fees from the top 10 projects

Base: $3.6m in gas fees from the top 10 projects (annualized to $14.4m)

Avalanche: $5.3m in gas frees from the top 10 projects

5. Addressable market

As a general rule, more value (market cap and value locked) has accrued to the base layer networks (the L1s) to date. We think this will persist. With that said, higher returns will likely accrue to the protocols and applications built “on top” moving forward. Keep in mind: with higher return potential comes higher risk.

Some back-of-the-napkin math:

Let’s say Ethereum were to reach a market cap of $2 trillion in the next cycle. And let’s assume that the L2s combine to capture 10 - 20% of Etheruem’s market value. This would put the potential valuation of the L2s at $200 - $400 billion. Given the power laws we’ve observed in crypto to date, the vast majority of that could accrue to a few general-purpose L2s. Arbitrum has a market cap of $1.4 billion today.

Again. More value on the L1, and potentially higher returns (and risk) on the layers above.

Looking at 365-day revenue multiples:

Arbitrum (and OP Mainnet) appear to be priced to perfection from a fully diluted perspective.

Here’s a quick view using circulating market caps:

Suddenly the valuations look much more reasonable. However, investors should keep in mind that 3.3 billion ARB tokens will unlock in the next two years.

For brevity's sake, we’re keeping the analysis very high-level here. Of course, there are many unknowns and many nuances unexplored. With that said, these are the critical questions we think investors should be asking:

- Will 28% margins persist for the general-purpose L2s? We think margins will drop in the coming years.

- What % of transactions move from L1 to L2 in the future? We think most transactions move to L2, but the value will stay on L1 (for security assurances).

- What premium does the market put on settlement guarantees (security & decentralization, i.e. Ethereum) vs execution services (L2s)? So far the market is valuing settlement over execution.

- Will the same power laws we’ve seen with L1s, DeFi, NFT markets, etc. apply to L2s? We haven’t seen any indicators to the contrary.

- How does value accrue to the token? The utility of ETH is clear as are its token economics. The same cannot be said for L2 tokens today.

- Where does the structural bid for L2 tokens come from? ETH is required to access services on the L1 and L2s. Furthermore, users can lock up tokens to earn yield. It’s unclear why one needs to hold an L2 token today, and what rights or yield it could offer in the future.

6. Product

Arbitrum One is the main rollup chain. When we say “rollup” we are referring to an L2 that inherits the security of Ethereum (such as Arbitrum) as opposed to a side-chain such as Polygon. This is where DeFi and other use cases that require maximum security reside.

Arbitrum Nova is a second-level network that focuses on games, NFTs, and social applications — which require more flexibility and throughput. Since these use cases are less financial in nature, less security is required as a trade-off. Nova was launched in August of ‘22 and leverages the AnyTrust protocol — which introduces additional trust assumptions in the form of a data availability committee (DAC) — comprised of organizations such as Reddit, Google Cloud, Consensys, Quick Node, and OpenSea.

Finally, Arbitrum launched Arbitrum Orbit in March of this year. Arbitrum Orbit is a product that makes it easy for anyone to make their own blockchain (app chain/L3) and manage it themselves, with transactions settling to Arbitrum One or Arbitrum Nova (which posts all “call data” to Ethereum).

There’s a lot going on here. The key takeaway for us is that Arbitrum’s network effect is growing. Their customer is app developers. And their product is the infrastructure that makes it easy for devs to build while inheriting the network effects and security of Ethereum. The more developers they are able to attract, the faster and larger that network effect will grow.

7. Team, investors, community

Team:

Arbitrum was born out of Princeton University when Professor Ed Felton (who previously served as the deputy Chief Technology Officer in Obama’s White House) convinced a few of his PhD students — Steven Goldfeder and Harry Kalodner to tackle the problem of scaling Ethereum. It all started in 2015, and you can find a YouTube video where the tech is first discussed. In 2018 research paper laid out a deeper vision before the tech was licensed from Princeton for the team to build out what is now known as Arbitrum. Today the Offchain Labs (the developer of Arbitrum) team has 73 employees. The Arbitrum Foundation has 62 employees today and is tasked with supporting ecosystem growth.

Investors:

The team raised $120m in August of ‘21 at a valuation of $1.2 billion. Notable investors include Lightspeed Ventures, Polychain Capital, Pantera Capital, and Mark Cuban. The team has raised a total of $143 million across three investment rounds.

Community:

Twitter: 886k followers

Reddit: 9k members

Discord: 21k members

8. Financials

9. Token economics

Circulating Supply: 1,275,000,000

Total Supply: 10,000,000,000 (12.75% circulating)

A quick breakdown of the token allocation & vesting schedules:

- Offchain Labs (the team behind Arbitrum): 26.9% allocation. None of the team’s tokens are vested just yet. 25% (673.5 million tokens) vests on 3.19.24 with linear vesting thereafter through March 2027.

- Arbitrum DAO & Treasury (supports ecosystem growth): 42.8% allocation. 105.8 million tokens (3%) are vested. The remaining tokens will vest on a linear schedule through March 2027.

- Investors: 17.5% allocation. The first 25% (438.25 million tokens) vest 3.19.24.

- Individual Users: 11.6% allocation. Arbitrum air dropped this supply to users in March of 2023. This makes up most of the circulating supply today.

- DAOs in the Ecosystem: 1.1% allocation which has already been distributed.

Note: Arbitrum launched in August of 2021. Given that the team and investors have not had a chance to liquidate any of their holdings, we should expect that to happen in the next cycle. Over 1.1 billion tokens (11% of the supply) will unlock on 3.19.24 (about 5 months out). The remaining insider tokens will then unlock on a monthly linear basis over the next 3 years. In total, over 30% of the token supply will unlock in the next two years.

10. Competition

We view Arbitrum’s primary competition as OP Mainnet and Base (both rollups). For simplicity, we added Polygon to the L2 section, even though it is a “side-chain” that utilizes its own token for gas fees — making Polygon less aligned with Ethereum.

L2s are all out to solve the key challenge with Ethereum L1: cost and throughput. Alternative L1s seek to solve the same problem — making them competitors to L2s as well. As we can see in the data, Arbitrum is not only the strongest L2, it is outpacing the alternative L1s on many important metrics.

We think Arbitrum’s primary competitive advantage is derived from its alignment with Etheruem as well as the flexibility of use cases offered by its diverse product suite. With that said, the market is still young.

In our opinion, the winning L2s/alternative L1s will achieve a moat via vast network effects that create a flywheel of permissionless innovation in the years to come.

11. Why now

- Network effects expanding via Arbitrum Nova & Arbitrum Orbit (app chains and new consumer use cases).

- EIP4844 (scaling): A major Ethereum upgrade scheduled to take place in Q4 will reduce fees on L2s by an order of magnitude.

- Given the strong fundamentals yet smaller market cap of L2s relative to alternative L1s, it’s possible that L2s outperform in the next cycle.

- The Bitcoin halving is in April of ‘24 and has historically kicked off bull markets. See The Setup for the Next Halving.

12. Risks

- Technical risk.

- Value capture risk. It’s unclear how value will be returned to token holders in the future and where the structural bid will come from for the ARB token.

- Competition. L2s are complements and could potentially be commoditized.

- Centralization. Arbitrum is centralized today.

- Tied to Ethereum’s success. Arbitrum is strategically aligned with Ethereum. Therefore, if Etheruem were to fail, so would Arbitrum.

13. Conclusion

What we like about Arbitrum:

- Alignment with Ethereum.

- Strong, mission-driven team and community.

- Building out tooling covering a broad range of use cases today — which can lead to strong network effects tomorrow.

- #1 among L2s across many important metrics.

The big unknown is how value accrues back to the token and where the structural bid will come from. With that said, it’s clear that Arbitrum is one of the most important projects in crypto.

As ever, if you’re investing in the Ethereum tech stack, you need to have a clear thesis as to why the token you’ve chosen will outperform ETH.

That’s for you to decide. We hope we’ve provided a framework here to help you develop your thesis.

Thanks for reading.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

- Customer stories: Token Terminal’s Data Partnership with Linea

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

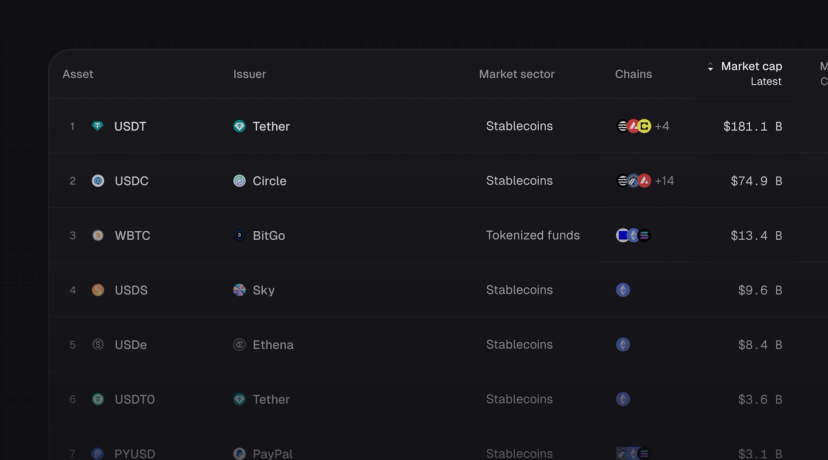

- Introducing Tokenized Assets

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

- Customer stories: Token Terminal’s Data Partnership with EigenCloud

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.